Using a automobile personal loan usually enables you to qualify for Chapter seven bankruptcy more conveniently since you can deduct yet another car ownership price on the implies test.

At this point, lenders will study your bankruptcies. Prior to transferring forward which has a new bank loan, it is important to grasp the specifics of which you filed for.

For those who are looking at filing for Chapter thirteen bankruptcy, plus your latest car or truck is on its past leg, it would be a lot more advantageous to buy a car or truck previous to filing your scenario. Here's why.

Chapter thirteen bankruptcy can continue being on your own credit score report for around seven a long time. Strategies to finance a car after bankruptcy

If you take a 401(k) personal loan prior to deciding to’re 59 ½ yrs old, you may be penalized and taxed should you don’t repay the financial loan. If you permit your employer even though the personal loan is exceptional, you can be necessary to repay the entire amount in ninety days.

If you’re willing to set up collateral, you could be able to acquire a secured particular bank loan after bankruptcy. Because your personal loan is going to be backed by an asset, such as the equilibrium of the savings account or perhaps the title to your car, chances are you'll obtain a decreased interest level than with a traditional particular mortgage. Nonetheless, in the event you default to browse around here the bank loan, the lender could choose possession of one's collateral.

Our significant criteria signify it is possible to sit up for an incredible provider and support when you will need it. We have now aggressive gives for any type of credit history.

The gives that click here to read appear on This page are from organizations that compensate us. This payment may well effect how and where solutions look on This great site, together with, by way of example, the order through go to website which they may look within the listing groups, except wherever prohibited by law for our house loan, house fairness as well as other advice household lending goods.

On the other hand, even though it could possibly be complicated, obtaining a personal mortgage after bankruptcy isn’t not possible. You’ll have to simply accept The reality that the lender will probable cost increased fees, along with the next desire amount.

If the vehicle mortgage listed on the credit history report was under no circumstances paid out off, It's going to be removed from your report after 7 several years. If the car financial loan is closed in very good standing, it will be eradicated after approximately 10 years.

By Colin Beresford Facts furnished on Forbes Advisor is for educational purposes only. Your money scenario is unique plus the products and services we review will not be right in your circumstances.

We're an unbiased, promoting-supported comparison services. Our target is to assist you make smarter economic conclusions by supplying you with interactive instruments and monetary calculators, publishing first and aim material, by enabling you page to definitely conduct investigate and Examine facts at no cost - so that you could make economical decisions with self confidence.

You'll really have to Dwell in just this spending plan for approximately 5 a long time. Throughout that point the court will frequently Check out your investing, and might penalize you severely when you aren't subsequent the program. Seem like entertaining? To top it off, it is going to stay with your record for 7 decades.

These further particulars allow our attorneys to realize a deeper idea of the details of one's circumstance

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Josh Saviano Then & Now!

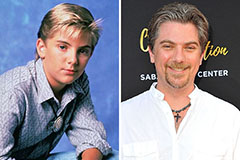

Josh Saviano Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now!